Prepared by: Sahar Mozafarian of SGPM

Iran is the most populated country in the Middle East with the latest statistics reporting 84.7 MLN people in the year to March 2023. In addition, the country is among the top 10 world emitters of green-house gases. Interestingly, a total of 23% of GHG emissions are related to road transportation and road vehicles are responsible for over 85% of pollutant emissions. It is worth noting that passenger cars rely on gasoline and CNG for fuel while diesel is utilized for heavy-duty vehicles.

Interestingly, gasoline consumption has experienced a significant increase. It has gone up from 89 MLN liters/day in 2018-2019 to 104.5 MLN liters/day in 2022-2023; some 17%. In turn, the number of passenger cars owned by 1,000 people of the population has increased from 175 in 2019 to 190 in 2021. This value is expected to increase to 209 in 2028. (https://www.statista.com/forecasts/1152178/car-parc-forecast-in-iran)

The import of foreign passenger vehicles has been prohibited for many years, limiting purchasing choice together with leaving the ground open for domestic carmakers to sell their products at their desired high prices. In the following section of this report, SGPM will look into the production and sales of the top three carmakers in the country: Iran Khodro, Saipa and Pars Khodro during the 2020 to 2023 timeframe.

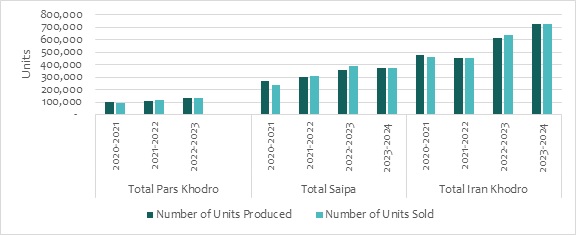

Passenger car production in the three companies has increased by an average of 29% over the three-year time frame; the breakdown of the three companies is as follows:

Passenger car production in the three companies has increased by an average of 29% over the three-year time frame; the breakdown of the three companies is as follows:

- Saipa unit production increased by 33.4% equivalent to 89,114 units

- Iran Khodro unit production increased by 27.4% equivalent to 131,746 units

Pars Khodro unit production increased by 26% equivalent to 27,476 units

Pars Khodro unit production increased by 26% equivalent to 27,476 units

In terms of sales units, figures are much higher. Unit sales of the three companies have increased by an average of 49.7% during the 2020 to 2023 timeframe; the breakdown of the three companies is as follows:

Saipa unit sales have increased by 152,764; some 64.5%

Saipa unit sales have increased by 152,764; some 64.5%- Pars Khodro unit sales they have gone up by 44,176 units; some 47.2%

- Iran Khodro unit sales have increased by 173,908 units; some 37.5%

Chart1: Number of Units Produced and Sold 2020-2024

Source: Codal;

*2023-2024 are company projections

In terms of sales figures, all three companies have experienced significant increases. This is due to a number of reasons including the significant devaluation of IRR currency, high inflation rates and the fact that domestic carmakers have a monopoly on the market, leaving little room for competition. The value of passenger car sales for the three companies have increased by an average of over 360% during the 2020-2023 timeframe; the breakdown of which has been mentioned below:

- Pars Khodro passenger car sales have increased by over four-fold; some 415.3%

- Iran Khodro passenger car sales have increased by over three and a half fold; some 352.4%

- Saipa passenger car sales have increased by over three-fold; some 314.8.4%

Chart2: Passenger Car Sales 2020-2024 (BLN Rials)

Source: Codal;

*2023-2024 are company projections

In the following section, the breakdown of the types of passenger vehicles produced in each of the three companies will be illustrated.

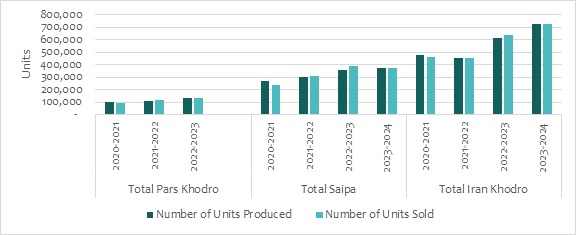

The major production for Pars Khodro passenger vehicles in the Q200 with over half of production to its name while the lowest was Quik S at under 1%.

Chart 3: Breakdown of Number of Passenger Car Units Produced in Pars Khodro 2022-2023

Source: Codal

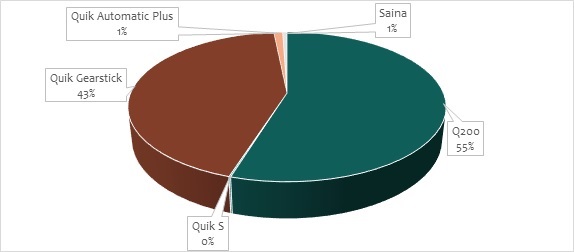

The major production for Saipa passenger vehicles in the X200 family of cars with over three quarters of production to its name.

Chart 4: Breakdown of Number of Passenger Car Units Produced in Saipa in 2022-2023

Source: Codal

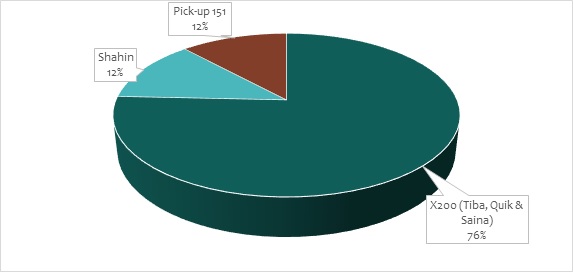

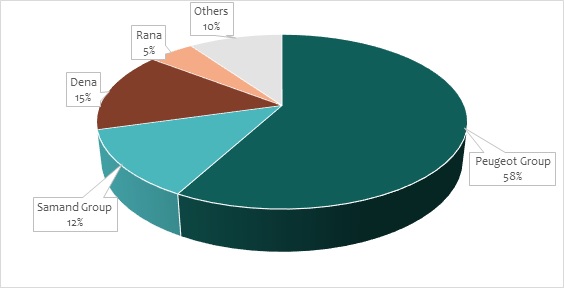

The major production for Iran Khodro passenger vehicles in Peugeot group of cars with close to 60% of production to its name while the lowest is the Rana at 5%.

Chart 5: Breakdown of Number of Passenger Cars Produced in Iran Khodro in 2022-2023

Source: Codal

Sources: CBI, Codal, Nour News, Science Direct, SGPM